*Financial transaction at ATM will include Cash withdrawal, Non-Financial transaction will include balance enquiry, PIN change, Mini statement request. #+ Top 6 Cities Transactions done in Mumbai, New Delhi, Chennai, Kolkata, Bengaluru and Hyderabad ATMs. #Cash withdrawal limit from other Domestic ATM is Rs.

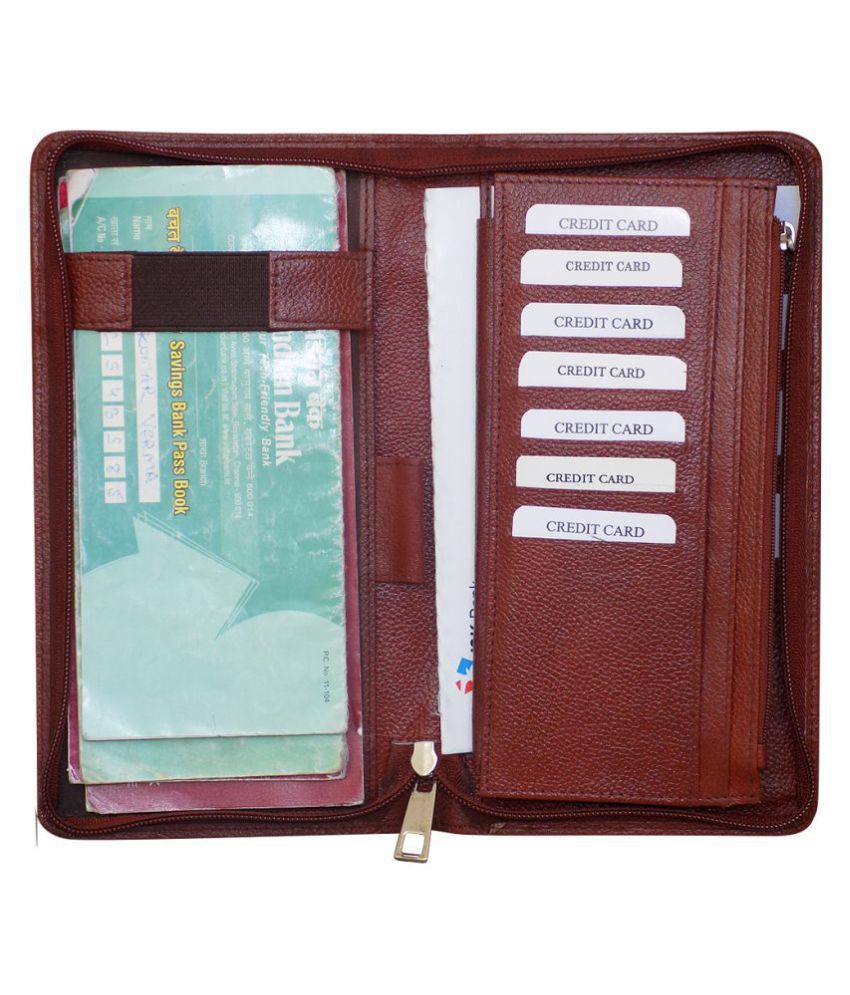

Chequebook holder full#

Customer won't be allowed to transfer funds through branch before the account is converted to Full KYC account. Customer can transfer a maximum amount of 1,00,000 through online transfers. No cheque book will be issued and cheque deposit will not be allowed to customers.įeatures of Kotak811 Limited KYC Account: Aggregate of all credit should not exceed 2 Lakh in a year and, Account balance at any point should not exceed 1 Lakh. Customer won't be allowed to transfer funds before the account is converted to Full KYC account. The aggregate of all credits should not exceed Rs. Balance in the account should not exceed Rs. Request for PIN generation/re-generation (sent through courier)įeatures of Kotak811 Lite Mobile Account: Aggregate of all credits should not exceed Rs. Statement Physical Monthly Physical Statement īalances and Transaction & Value added alerts (Daily / Weekly)Ĭheque purchase charges: 0.5/1000 (Min 50: Revalidation / Cancellation( INR) Annual Combined Statement, Foreign Inward Remittance Certificate,ĭuplicate Passbook, TDS Cerificate Through Branch orĪny other Record Retrieval, Stop Payment Single / (Min 25 leaves in one cheque book when requested via Kotak Mobile Banking App)ĮCS / Cheque Issued & Returned (due to non-availability of funds)ĭuplicate Ad-hoc statement, Balance & Interest 1000/-įCY DD / TT / Cheque Collection / Revalidation / Cancellation / for Financial transactions and 25 / Txn for non-Financial transactionsįor senior citizens Rs. 10/- per transactionįinancial Transaction / Non-Financial Transaction at International ATM +ġ50 / Txn. Nil charges up to 1 transaction per month and subsequent transactions will be charged Rs. Transactions declined at merchant outlets/websites/ATMs, due to insufficient balance(w.e.f April 1,2019) financial & non-financial) in a month with a cap of Maximum 3 nil charges in Top 6#+ Cities, thereafter Financial Transaction 21.00 / Txn.ĭeclined Transactions due to insufficient balance Maximum of 5 transactions nil charges (incl. Other Domestic ATMS Financial Transaction / Non-Financial Transaction# Kotak Bank's ATM Financial Transaction / Non-Financial Transaction*ĥ financial Transaction / month nil charges, thereafter Financial Txn. One time image cost basis selected Image + Rs. My Team/Other Image Debit Card (available on request only) 150)ĭebit Card / ATM Charges (Virtual Debit Card)ĭebit Card / ATM Charges (with Physical Debit Card)Ĭlassic Debit Card-Annual Fees Or Replacement of Lost Debit Card (Physical Debit card) Nil Charges upto 4 transactions or 1 lac / month,

Whichever is earlier (applicable for both cash Nil Charges for 1 transaction or 10,000 / month, NEFT / RTGS / Funds Transfers / IMPS (Through Net / Mobile Banking)#

0 kommentar(er)

0 kommentar(er)